In today’s ever-evolving real estate market, understanding the dynamics between homebuilders slowdown and existing home prices is crucial for informed decision-making. As building material costs continue to fluctuate, they are significantly impacting the pace at which new homes are built, subsequently influencing the broader housing market trends. For home buyers and real estate investors, this presents both challenges and opportunities, as navigating these changes can lead to strategic advantages. By analyzing the relationship between the cost of building materials and existing home prices, this guide aims to provide clarity and empower readers with actionable insights. Join us as we delve into a comprehensive housing market analysis that offers transparency and equips you to make confident, cost-effective real estate choices.

Understanding the Homebuilders Slowdown

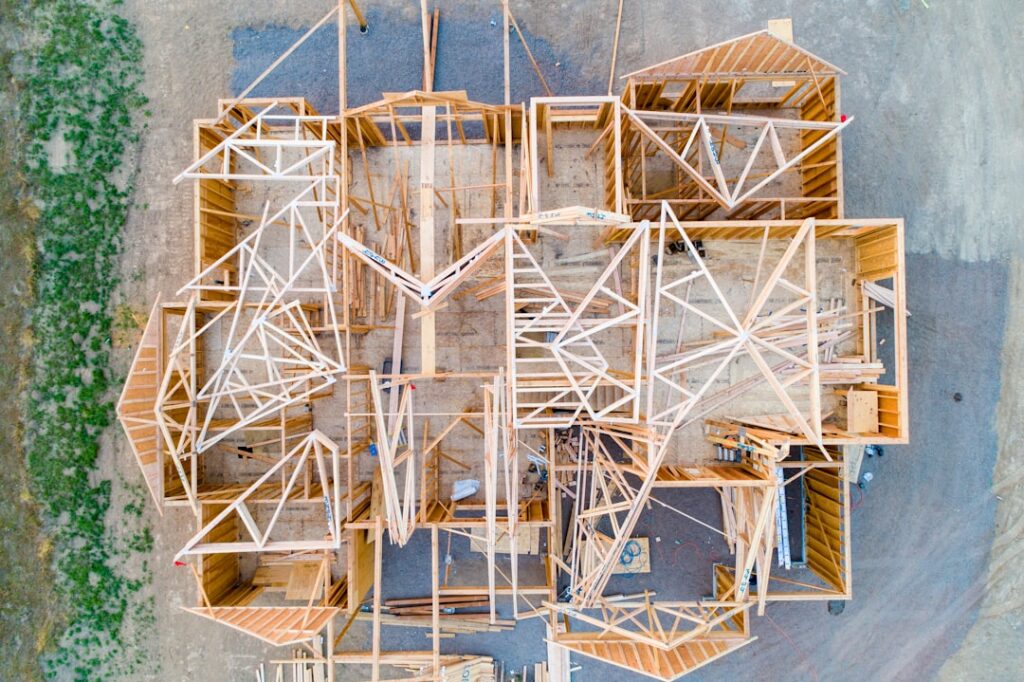

As the real estate market evolves, the slowdown in home construction has become a focal point for buyers and investors. Understanding the factors driving this trend is essential to navigating the current market landscape. This section will explore the underlying causes of the slowdown, the role of building material costs, and how these elements influence home price trends.

Factors Behind the Slowdown

Several factors contribute to the current homebuilders slowdown. Supply chain disruptions have significantly delayed construction timelines, leading to fewer new homes entering the market. Additionally, labor shortages in the construction industry have compounded these delays, making it challenging to meet housing demands.

The economic climate also plays a role. Rising interest rates have increased borrowing costs, discouraging new construction projects. Builders are also cautious due to concerns about consumer demand, as potential buyers face financial uncertainties.

To better understand these dynamics, the Wall Street Journal highlights how slumping housing starts and builder earnings signal a softer new home market. This context underscores the complex interplay of economic and logistical factors influencing the slowdown.

Building Material Costs Explained

Fluctuating building material costs have been a significant factor in the homebuilders slowdown. Lumber prices, for example, have seen dramatic swings, impacting the affordability of constructing new homes. Volatility in material prices has forced builders to reassess project budgets and timelines.

According to the National Association of Home Builders, soaring prices for materials like steel and concrete further exacerbate the issue. Tariffs and trade policies have also contributed to these cost increases, as highlighted by MarketWatch.

In response, builders are adopting alternative strategies. Some are using more cost-effective materials or altering home designs to curb expenses. These adjustments aim to mitigate the impact of high material costs on overall project feasibility.

Impact on Home Price Trends

The slowdown in new home construction directly affects home price trends. With fewer new homes available, the demand for existing homes increases, often leading to price hikes. This trend creates a ripple effect in the broader real estate market.

An analysis of these market dynamics reveals a pattern: as new construction slows, existing home prices rise. This is because the limited supply of new homes pushes buyers to compete for existing properties. Consequently, this competition can drive up prices, impacting affordability for many buyers.

In a Yahoo Finance article, experts suggest that while some relief may come from easing tariffs, the housing market still faces challenges from these trends. Understanding this interplay is crucial for buyers aiming to make informed purchasing decisions.

How Existing Home Prices Are Affected

The effects of the homebuilders slowdown extend beyond new construction, influencing the pricing and availability of existing homes. This section examines the dynamics of the real estate market, analyzes current housing trends, and forecasts future price changes.

Real Estate Market Dynamics

The real estate market is inherently dynamic, with various factors influencing price movements. Supply and demand play a crucial role, and in the current landscape, limited new home construction intensifies demand for existing properties.

Key Influences on market dynamics include:

- Interest Rates: Rising rates can deter potential buyers, affecting demand.

- Economic Conditions: Consumer confidence and employment rates impact purchasing power.

- Regulatory Changes: Policies affecting affordability and lending practices can shift market trends.

These elements create a complex environment where existing home prices respond to broader economic signals. Understanding these dynamics is vital for buyers and investors seeking to navigate the market effectively.

Analysis of Housing Market Trends

Analyzing housing market trends provides insights into how existing home prices may evolve. Current trends indicate a shift towards higher prices due to constrained supply and robust demand.

Key Observations include:

- Limited Inventory: The shortage of new homes increases competition for existing properties.

- Price Increases: Many markets experience price appreciation due to high demand.

- Regional Variations: Some areas see more pronounced changes based on local economic conditions.

A thorough housing market analysis reveals these patterns, offering valuable insights for prospective buyers. By understanding these trends, individuals can better anticipate market movements and adapt their strategies accordingly.

Forecasting Future Price Changes

Forecasting future changes in home prices involves considering current trends and potential economic shifts. While predictions can vary, several key factors influence future price trajectories.

Experts suggest:

- Monitoring Economic Indicators: Economic growth and employment rates provide insight into potential demand changes.

- Adapting to Regulatory Changes: Stay informed about policies that may affect housing affordability.

- Considering Regional Differences: Local market conditions can significantly impact price movements.

By staying informed and proactive, buyers and investors can position themselves to capitalize on market opportunities. As the real estate landscape evolves, understanding these forecasts is essential for strategic decision-making.